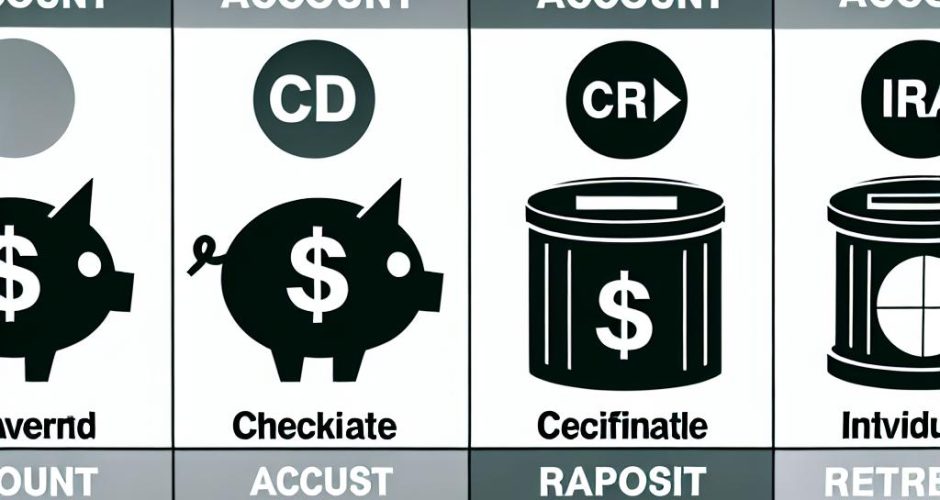

Understanding Different Types of Bank Accounts

Navigating through the world of banking can seem overwhelming, given the variety of account options available. Understanding the distinct features and uses of each type is essential for making informed financial decisions. Below, we take a closer look at some common types of bank accounts and their uses.

Checking Accounts

A checking account is designed for frequent transactions such as deposits, withdrawals, and transfers. These accounts provide easy access to your funds through various channels like checks, ATMs, and debit cards. Many banks also offer online and mobile banking services, enhancing the convenience of managing your finances from virtually anywhere. By leveraging these platforms, users can perform activities like bill payments, fund transfers, and balance inquiries without visiting a branch.

Checking accounts often come with a variety of fees, such as maintenance fees, overdraft charges, and ATM fees. Some banks offer fee-free accounts under certain conditions, such as maintaining a minimum balance or enrolling in direct deposit. Understanding the fee structure and services of different checking accounts is crucial when selecting the right one for your needs. Some accounts may also offer overdraft protection, which is an optional service that covers transactions exceeding your available balance. While this provides an added safety net, it is vital to understand the associated costs.

Savings Accounts

A savings account is intended for storing money that is not needed immediately, allowing you to earn interest over time. It serves as a secure way to set aside funds for future needs or goals, such as a vacation, education, or an emergency fund. Interest rates on savings accounts vary significantly between banks, so it is advisable to compare different options for the best return on your savings. Some banks may offer tiered interest rates based on your balance level, rewarding those who save more.

It’s important to note that savings accounts typically have limitations on the number of transactions you can make each month. This restriction encourages users to save rather than spend money frequently. Before opening a savings account, consider your savings goals and the account terms to ensure they align with your financial plans. Being aware of any withdrawal limitations and associated penalties can help you choose the most suitable savings account for your lifestyle.

Money Market Accounts

A money market account (MMA) is a type of savings account that usually offers higher interest rates, blending features of both savings and checking accounts. One can expect an MMA to require a higher minimum balance to avoid fees, yet it often provides limited check-writing capabilities and debit card usage. This combination means an MMA can offer flexibility for accessing funds while still encouraging savings.

Money market accounts are ideal if you’re seeking to earn more interest while maintaining some liquidity. These accounts may offer varying rates based on the deposited balance, so it’s vital to carefully evaluate their terms and conditions to ensure they suit your financial needs before committing. Comprehending the account limits, such as the number of withdrawals allowed, aids in effectively utilizing an MMA.

Certificates of Deposit

A certificate of deposit (CD) is a fixed-term deposit account that offers higher interest rates compared to traditional savings accounts. When opening a CD, you agree to deposit a specific amount of money for a predetermined period, known as the term length, which can range from a few months to several years. The interest rate remains fixed for the duration of the term, offering predictability for savers.

One critical aspect of a CD is the penalty for early withdrawal. Withdrawing funds before the maturity date typically results in monetary penalties, which can eat into your interest earnings and even principal balance. Despite the lack of flexibility, CDs are an excellent choice for those looking to set aside funds without the need for immediate access. They are especially appealing for those seeking a guaranteed return on investment with minimal risk, as funds are insured by organizations like the FDIC in the United States.

To make the most of a CD, it’s beneficial to compare rates and terms across different banks to find the best option for your investment strategy. Considerations include the length of the term, interest rates, renewal policies, and the bank’s reputation. By carefully assessing these factors, you can ensure your CD investment aligns with your financial goals.

Retirement Accounts

Retirement accounts are specialized accounts designed to help individuals save for retirement, often providing substantial tax advantages. Common types of retirement accounts include Individual Retirement Accounts (IRAs) and 401(k) plans. Each of these accounts comes with specific rules regarding contributions, withdrawals, and tax implications.

IRAs and 401(k) plans represent two popular retirement savings vehicles, each tailored for different purposes. An IRA is an account you open and manage independently, often offering more investment choices. In contrast, a 401(k) plan is typically provided by an employer, featuring convenient payroll deductions and sometimes, employer matching contributions.

Choosing the right retirement account depends on your current financial situation and future retirement goals. Factors to ponder include your expected retirement age, income level, and ability to make contributions. Consulting financial advisors or resources can provide guidance in making these important decisions. It’s valuable to familiarize yourself with the contribution limits, tax considerations, and withdrawal rules associated with each account type to maximize your retirement savings.

Conclusion

Selecting the appropriate bank account hinges on your financial objectives and personal circumstances. By comprehending the various types of accounts and how to use them effectively, you can optimize your banking strategy to meet your needs. It’s crucial to assess not only the features and benefits of different accounts but also the associated costs and limitations to ensure you are making educated financial decisions. By taking a strategic approach, you can confidently navigate the banking landscape and work towards achieving your financial aspirations. For further information on these accounts and additional financial tips, visit [Learn More](https://example.com).

This article was last updated on: March 27, 2025