Venmo is a US-based digital wallet owned by PayPal that allows users to send and receive money via their mobile devices. It’s known for its convenience, instant transfer capabilities, and integrated social features. But the question remains—is it a good option for people in the UK? This article will explore specifics about Venmo and its potential benefits or limitations for UK users.

Venmo is a US-based digital wallet owned by PayPal that allows users to send and receive money via their mobile devices. It’s known for its convenience, instant transfer capabilities, and integrated social features. But the question remains—is it a good option for people in the UK? This article will explore specifics about Venmo and its potential benefits or limitations for UK users.

What is Venmo and How does it Work?

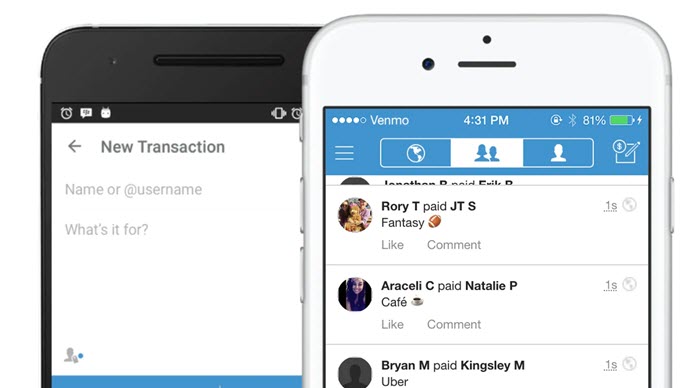

Venmo is a peer-to-peer (P2P) money transfer mobile app that enables users to send, pay, and receive money swiftly and efficiently. Besides facilitating quick money transfers, Venmo also incorporates a social dimension – users can add descriptions, comments, and emojis to their transactions, making money transfers an interactive and engaging experience.

The Key Features of Venmo:

Instant transfers:

Venmo provides instant transfers to users who opt for its Instant Transfer feature. Instead of waiting 1-3 days for a standard bank transfer, users can transfer funds from Venmo to their bank account within 30 minutes for a small fee. This allows you to do anything from sending money to a friend to depositing money to brokers that accepts venmo.

The Venmo Mastercard:

Venmo users can opt for the Venmo Mastercard, which is a physical debit card linked to their Venmo balance. This card allows users to make payments at all locations where Mastercard is accepted.

Social networking:

Transactions on Venmo can be publicly shared on the platform’s social feed. Users can ‘like’ or comment on these shared transactions, making it a unique blend of finance and social media.

Is Venmo a Suitable Option for the UK?

Unfortunately, as of now, **Venmo is only available to users in the United States.** Its services, including sending and receiving money and the associated Mastercard, are not open to users living in the United Kingdom or other international territories.

However, there’s a silver lining. Folks in the UK can access similar services like PayPal, which works globally and offers features like instant transfers, money requests, and business transactions. PayPal is also the parent company of Venmo, so a great deal of the user experience is shared.

Understanding PayPal and its effectiveness in the UK:

Universal Application:

PayPal is a globally recognized payment system that numerous online retailers and services accept. Users can make international transfers, serving as a great solution for UK users who want functionality similar to Venmo.

Currency Conversions:

With PayPal, users can send, receive and hold balances in their PayPal accounts in multiple currencies. Also, it provides a seamless currency conversion process.

Security Measures:

PayPal maintains high security standards, with end-to-end encryption and 24/7 transaction monitoring, giving its users an additional layer of safety.

Conclusion

While Venmo stands out with its unique social aspect and straightforward interface, it currently lacks availability in the UK. Nevertheless, UK residents can use services like PayPal, which not only offers similar features but also the advantage of being globally recognised and widely accepted. As the digital wallet market continues to evolve, it’s only a matter of time until more apps similar to Venmo become accessible to users worldwide.